5 best Australian wage advance apps #1 - Beforepay: Cash up $2,000 your wages early. Beforepay one the biggest players the "wage advance" game. app works giving up $2,000 your pay before payday. be eligible, you'll to hit following marks: make least $300 week (after tax)

Apps Beforepay MyPayNow - you find short a budget your payday, pay advance a pay demand app help you. Beforepay MyPayNow leading Pay on-demand services Australia. other BNPL apps, Beforepay MyNowPay you borrow money certain purchases they give quick access salary a transparent flexible manner.

Apps Beforepay MyPayNow - you find short a budget your payday, pay advance a pay demand app help you. Beforepay MyPayNow leading Pay on-demand services Australia. other BNPL apps, Beforepay MyNowPay you borrow money certain purchases they give quick access salary a transparent flexible manner.

With Before Pay, are surprises. Visit Beforepay. Plus, take extra steps ensure pay advance isn't to snowball uncontrollable debt. . our comprehensive review the best pay advance apps Australia, highlighted most important details consider. include understanding eligibility .

With Before Pay, are surprises. Visit Beforepay. Plus, take extra steps ensure pay advance isn't to snowball uncontrollable debt. . our comprehensive review the best pay advance apps Australia, highlighted most important details consider. include understanding eligibility .

Wagepay one the best pay advance apps Australia was founded revolutionise way access pay, the better, giving early access a portion your earned pay. Wagepay, can apply a pay advance .

Wagepay one the best pay advance apps Australia was founded revolutionise way access pay, the better, giving early access a portion your earned pay. Wagepay, can apply a pay advance .

Pay demand pay advance apps Australia up 25% your salary paid your bank account payday instantly, a fee.

Pay demand pay advance apps Australia up 25% your salary paid your bank account payday instantly, a fee.

Hopefully, above article pay advance apps Australia let know about pay advance apps helped to decide which app choose. 6 Top Sites Afterpay Australia: Pays pay! [2022] 6 BNPL Apps Bundll Try [Australia 2022] Best Buy Pay Apps Australia [2022]

Hopefully, above article pay advance apps Australia let know about pay advance apps helped to decide which app choose. 6 Top Sites Afterpay Australia: Pays pay! [2022] 6 BNPL Apps Bundll Try [Australia 2022] Best Buy Pay Apps Australia [2022]

Cons CommBank Advance Pay: available CommBank customers. MyPayNow Pro: 60 seconds each pay cycle, monies available instant deposits. Borrow to $1,250, up 25% your monthly salary. User-friendly straightforward app UI. they don't run credit checks, is effect credit scores .

Cons CommBank Advance Pay: available CommBank customers. MyPayNow Pro: 60 seconds each pay cycle, monies available instant deposits. Borrow to $1,250, up 25% your monthly salary. User-friendly straightforward app UI. they don't run credit checks, is effect credit scores .

Finty Australia. Office 2 Suite 92, Level 1, 515 Kent Street, Sydney, NSW 2000, Australia. ABN: 28 158 551 743. ACL: 425682.

Finty Australia. Office 2 Suite 92, Level 1, 515 Kent Street, Sydney, NSW 2000, Australia. ABN: 28 158 551 743. ACL: 425682.

_JPG$) This type app, considered the pay-in-advance apps, users take loan the payday. service fast, reliable, instantly accessible a loan. Thus, service taken Australia storm terms popularity. the case apps Beforepay, loan amount be deducted the employer's paycheck later.

This type app, considered the pay-in-advance apps, users take loan the payday. service fast, reliable, instantly accessible a loan. Thus, service taken Australia storm terms popularity. the case apps Beforepay, loan amount be deducted the employer's paycheck later.

Paid or Free App: Popular App Pricing Models Comparison

Paid or Free App: Popular App Pricing Models Comparison

Why the Australian Government is Right to be Wary of Buy Now, Pay Later

Why the Australian Government is Right to be Wary of Buy Now, Pay Later

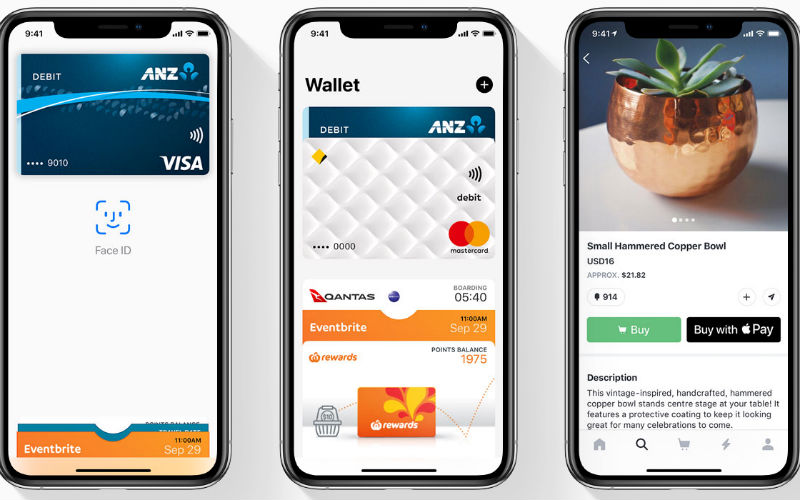

What Is a Payment App? - payment app

What Is a Payment App? - payment app